What Does San Diego Home Insurance Mean?

What Does San Diego Home Insurance Mean?

Blog Article

Obtain the Right Protection for Your Home With Tailored Home Insurance Policy Protection

Customized home insurance policy coverage provides a safety net that can supply tranquility of mind and economic protection in times of situation. Navigating the complexities of insurance plans can be challenging, particularly when attempting to determine the specific protection your special home requires.

Importance of Tailored Home Insurance

Crafting a tailored home insurance plan is important to make certain that your protection properly mirrors your specific demands and conditions. A customized home insurance plan surpasses a one-size-fits-all method, offering you certain protection for your unique circumstance. By working carefully with your insurance policy service provider to tailor your policy, you can assure that you are effectively covered in the occasion of a case.

One of the vital benefits of tailored home insurance is that it enables you to consist of insurance coverage for products that are of certain value to you. Whether you have costly precious jewelry, unusual art work, or specific tools, a customized plan can ensure that these ownerships are safeguarded. In addition, by tailoring your protection, you can change your limits and deductibles to align with your threat resistance and financial abilities.

Moreover, a tailored home insurance coverage takes into consideration factors such as the place of your home, its age, and any kind of distinct attributes it may have. This tailored method assists to reduce prospective spaces in insurance coverage that can leave you subjected to dangers. Eventually, spending the moment to tailor your home insurance policy can offer you with comfort understanding that you have thorough defense that meets your certain demands.

Assessing Your Home Insurance Policy Demands

When considering your home insurance policy requires, it is critical to examine your private conditions and the certain risks linked with your residential or commercial property. Analyze the age and condition of your home, as older homes may require more upkeep and might be at a greater threat for problems like plumbing leaks or electrical fires.

By thoroughly examining these variables, you can determine the level of coverage you need to adequately safeguard your home and possessions. Bear in mind, home insurance coverage is not one-size-fits-all, so customize your plan to meet your details demands.

Customizing Protection for Your Residential Or Commercial Property

To customize your home insurance plan efficiently, it is necessary to tailor the insurance coverage for your details property and individual needs. When tailoring insurance coverage for your building, take into consideration factors such as the age and building of your home, the value of your valuables, and any kind of special functions that may require unique insurance coverage. As an example, if you possess costly fashion jewelry or artwork, you may require to include extra protection to protect these things properly.

In addition, the area of your residential property plays a critical function in personalizing your coverage (San Diego Home Insurance). Residences in locations prone to natural disasters like quakes or floods might need additional this article insurance coverage not included in a conventional plan. Comprehending the dangers related to your location can aid you tailor your insurance coverage to reduce prospective damages properly

Furthermore, consider your way of living and personal preferences when personalizing your insurance coverage. If you often take a trip and leave your home vacant, you may want to add coverage for theft or vandalism. By customizing your home insurance coverage to match your specific demands, you can make sure that you have the appropriate protection in position for your residential or commercial property.

Understanding Policy Options and Boundaries

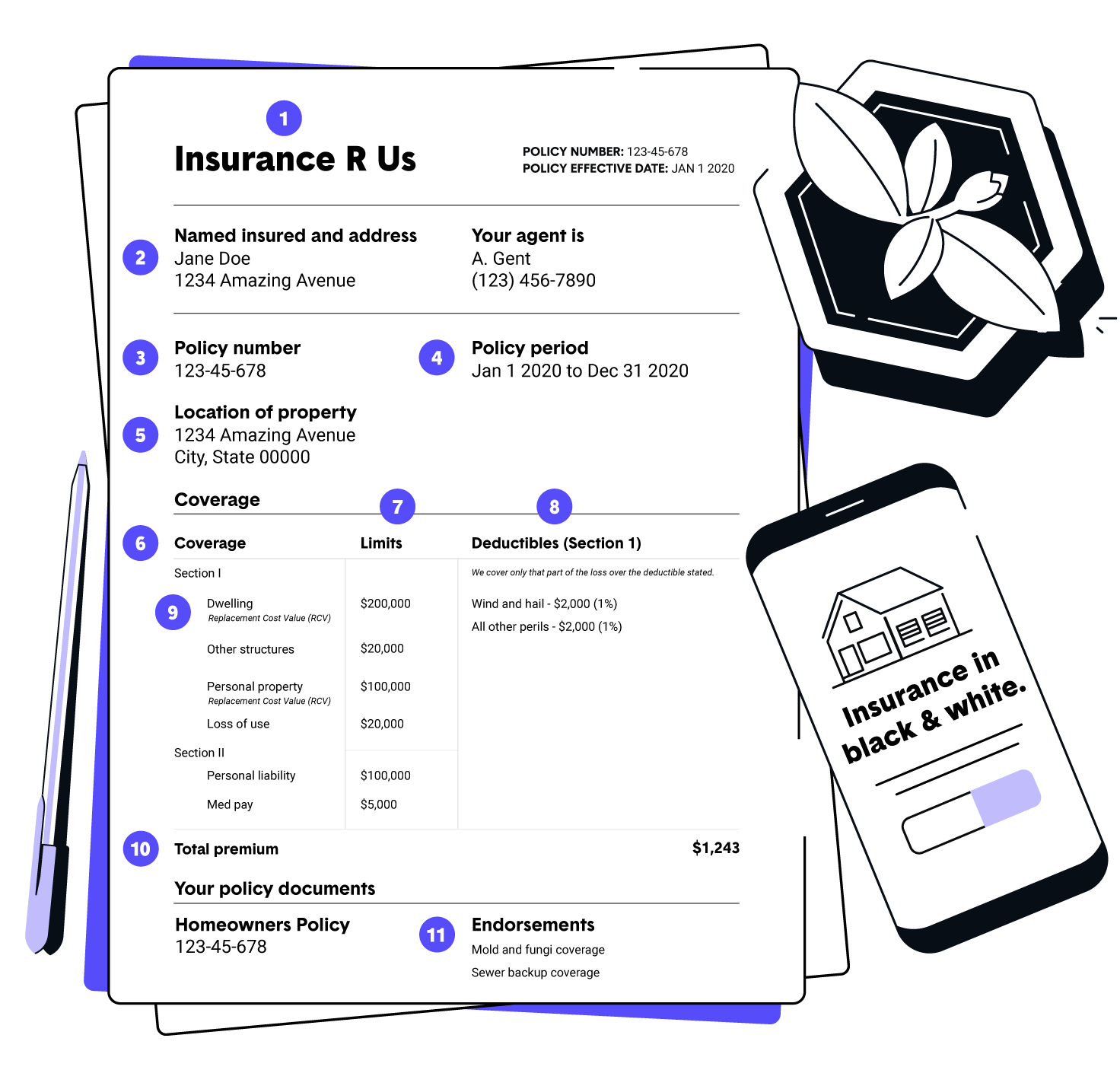

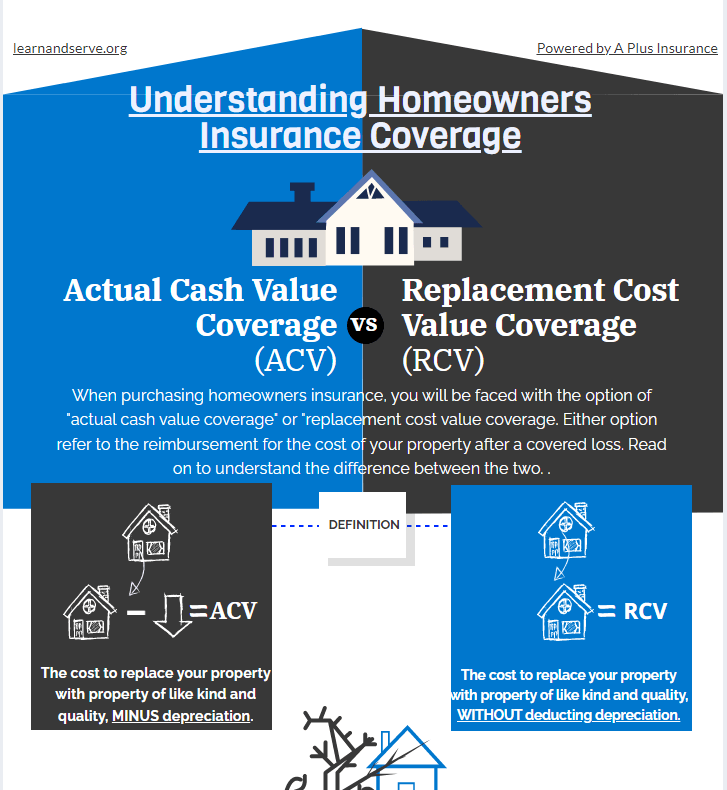

Discovering the various plan alternatives and limitations is vital for getting a detailed understanding of your home insurance protection. When selecting a home insurance plan, it's vital to very carefully review the various alternatives readily available and guarantee they align with your certain demands. Policy alternatives can include insurance coverage for the structure of your home, personal valuables, liability security, extra living expenses, and extra. Understanding the limitations within each of these coverage locations is just as essential. Plan restrictions determine the maximum amount your insurance coverage provider will pay for a protected loss. It's essential to evaluate whether these limits properly protect your possessions and responsibilities in the occasion of a claim. Think about aspects such as the worth of your home, the cost to change your individual possessions, and any type of potential dangers that might call for additional protection. By carefully checking out policy options and limitations, you can customize your home insurance policy protection to provide the protection you require.

Tips for Choosing the Right Insurer

Understanding the relevance of picking the best insurance provider is Get More Info critical when guaranteeing your home insurance policy coverage lines up completely with your demands and gives the essential defense for your possessions. When choosing an insurance provider for your home insurance policy, consider variables such as the business's credibility, financial security, consumer service quality, and insurance coverage alternatives. By following these pointers, you can make a notified choice and pick the best insurance company for your home insurance coverage requires.

Conclusion

Crafting a customized home insurance plan is necessary to make certain that your insurance coverage accurately mirrors your specific demands and conditions (San Diego Home Insurance). Examine the age and condition of your home, as older homes might need even more upkeep and can be at a higher threat for concerns like pipes leaks or electric fires

To tailor your home insurance coverage plan successfully, it is vital to customize the protection for your specific residential property and individual demands. When customizing protection for your residential or commercial property, consider aspects such as the age and building of your home, the worth of your possessions, and any kind of special attributes that may need unique coverage. By carefully examining policy choices and limits, you can tailor your home insurance coverage to offer the defense you need.

Report this page